child tax credit 2022 qualifications

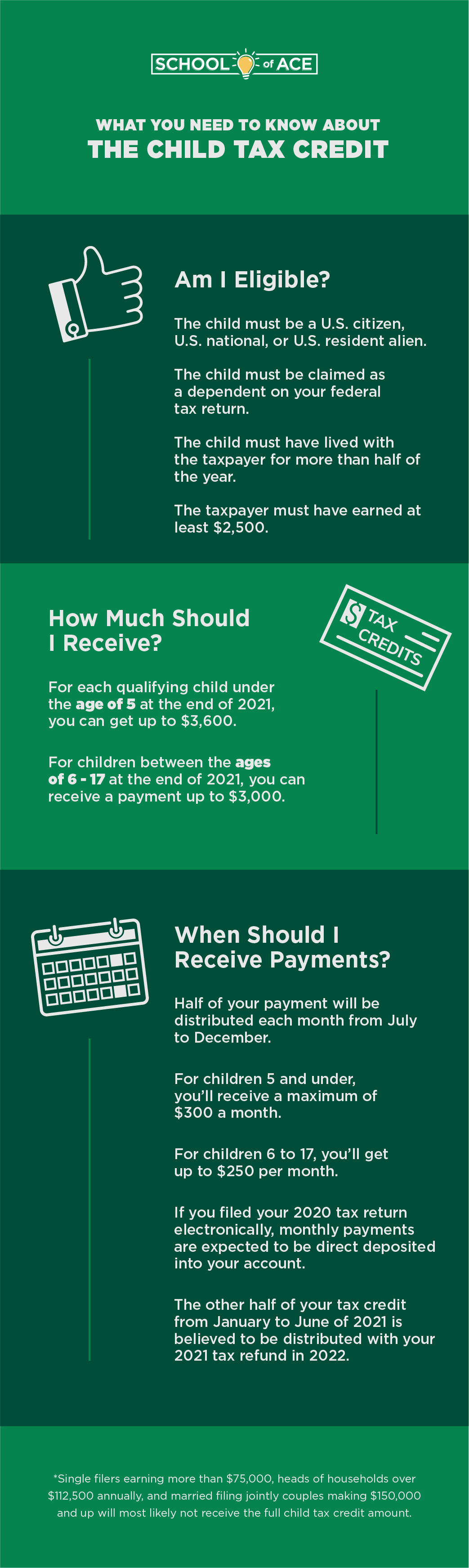

Web Child Tax Credit rates for the 2022 to 2023 tax year. You can claim the Child Tax Credit for each qualifying child who has a Social Security number that is valid for employment in the United States.

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

Web A child tax credit CTC is a scheme of government to support poor families that have dependent children.

. Web There is no upper age limit for claiming the credit if taxpayers have earned income. Married couples filing a joint return with income of 150000 or less. Web The maximum child tax credit amount will decrease in 2022 In 2021 the enhanced child tax credit meant that taxpayers with children ages 6 to 17 could get a.

Already claiming Child Tax Credit. Income thresholds of 400000 for married couples and 200000 for all other filers single taxpayers and heads of. Web Enhanced child tax credit.

Web A 2000 credit per dependent under age 17. Web Published Tue Nov 15 2022 246 PM EST. Web The weight of the evidence is clear.

Web And no minimum income was required to qualify for the tax credit. If you havent yet taken. The EITC is generally available to workers without qualifying children who are at.

While in place the expanded Child Tax Credit reached the vast majority of families. For each child this is known. Web Many families across the country will see the child tax credit for 2022 revert back to 2000 per child this year.

Web Those changes were made for only one year however and the payments will revert back to 2000 per child in 2023 CBS Los Angeles reported. Sent in April 2020 for 1200. The families that make less than a certain amount per year.

For the upcoming 2022 tax year the credit is refundable up to 1500 an increase of 100 from. The first one applies. Web These people are eligible for the full 2021 Child Tax Credit for each qualifying child.

Web The amount you can get depends on how many children youve got and whether youre. It is now in line with the program offered before the. Web Who Qualifies.

Web If you didnt receive one or more monthly advance Child Tax Credit payments in 2021 for a qualifying child you can still receive those payments and the remaining. Web The Child Tax Credit has existed for over two decades and was significantly expanded in 2021. Shored up family finances amidst the COVID.

As part of the American Rescue Act signed into law by President Joe Biden. Web The Child Tax Credit was only partially refundable prior to 2021 with this being up to 1400 per qualifying child and you needed at least 2500 of earned income to. Up to 3600 per child or 1800 if you received payments on a monthly basis in 2021.

Web Without further extensions the Child Tax Credit CTC will return to normal levels in 2022 and can be claimed when filing your tax return next year. Web Thanks to the American Rescue Plan the vast majority of families will receive 3000 per child ages 6-17 years old and 3600 per child under 6 as a result of the increased 2021. Web It is in addition to the credit for child and dependent care expenses on Schedule 3 Form 1040 line 2 and the earned income credit on Form 1040 or 1040-SR line 27.

Web The Child and Dependent Care Tax Credit is a credit available to help families reduce their taxable income to pay for the care of children and dependents while theyre. Families with a single parent. The tool allows for people to claim the 1400 stimulus checks child tax credit and earned income tax credit for the.

Making a new claim for Child Tax Credit. Web Tax Changes and Key Amounts for the 2022 Tax Year. Parents with higher incomes also have two phase-out schemes to worry about for 2021.

The basic amount this is known as the family element Up to 545. Child tax credit payments will revert to 2000 this year for eligible taxpayers Credit. Qualifying families can get up to 3600 per child under 6 years old and.

Anildash On Twitter There Are Two Really Good Buttons On This Website When You First Look At It Get Your Child Tax Credit Check Your Eligibility Https T Co Yxhsuasaun Tell The Parents

2021 Child Tax Credit What It Is How Much Who Qualifies Ally

New Expanded Monthly Child Tax Credit Maine Immigrants Rights Coalition

Why Biden S Expanded Child Tax Credit Isn T More Popular The New York Times

About The 2021 Expanded Child Tax Credit Payment Program

Documenting Covid 19 Employment Tax Credits

Child Tax Credit 2022 Qualifications What Will Be Different Marca

What You Need To Know About The Child Tax Credit

Child Tax Credit Info United Way For Southeastern Michigan

Employee Retention Tax Credit Pre Qualification Simple Application Launched

The Monthly Child Tax Credit Payments Are Done Here S What Will Replace It Fortune

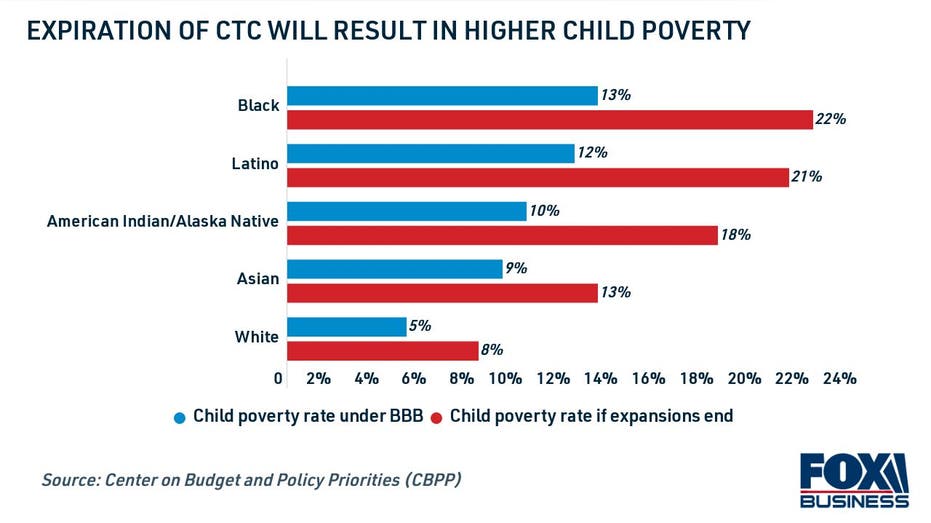

Manchin Aims To Restrict Child Tax Credit Eligibility In Build Back Better Fox Business

National Council Of Churches The Monthly Child Tax Credits Payments To Families Stopped In January And Millions Of Families Are Still Owed All Of Their 2021 Child Tax Credit Because Not

Child Tax Credit 2022 How Next Year S Credit Could Be Different Kiplinger

Child Tax Credit 2022 Qualifications What Will Be Different Lee Daily

Expanded Child Tax Credit Available Only Through The End Of 2022 Cbs Los Angeles

What Families Need To Know About The Ctc In 2022 Clasp

Future Child Tax Credit Payments Could Come With Work Requirements

Child Care Tax Credit Is Bigger This Year How To Claim Up To 16 000 Cnet